Cryptocurrency Trading

Trade in digital assets and uncover their potential!

What do you mean by Cryptocurrency Trading?

Are you willing to get straight into action? The act of venturing into the different cryptocurrency price movements in the market via a CFD trading account or cryptocurrency trading via an exchange.

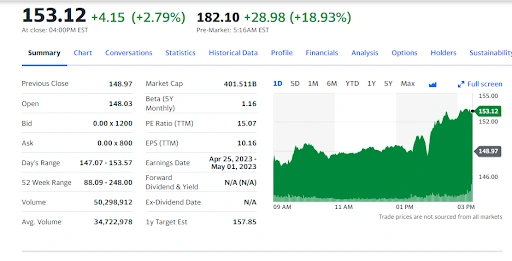

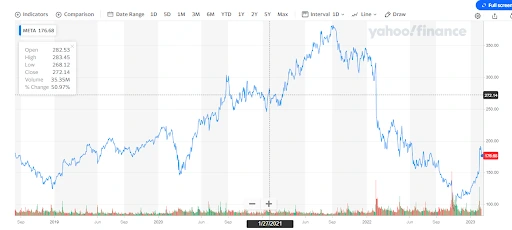

The majority of investors like to trade cryptocurrency because it is a highly volatile asset. It is a skill to time the market right; trading crypto has given much higher returns than traditional investments.

Cryptocurrency traders have two goals: generating a profit in USD through buying and selling or collecting Bitcoin. If the crypto market is bullish, your portfolio's USD value will surge, but Bitcoin will struggle to achieve greater levels. Due to this, several traders track the value of Bitcoin by trading other altcoins against that particular cryptocurrency on various other exchanges.

Traders don’t understand that trading their cryptocurrency can risk losing it to the market. Since cryptocurrency prices are so volatile, it’s prevalent for traders to lose money drastically while trading cryptocurrencies. The only reason why many crypto enthusiasts just HODL their bitcoin

CFD trading on cryptocurrencies

CFDs are derivatives that help you navigate into cryptocurrency price spikes , and you can do this with every coin without even owning the coins. You can also go long, i.e., purchase, if you feel the value of the digital asset might surge, or short, i.e., sell, if you believe the value might dip.

Both options are leveraged products, meaning you only need to deposit a small amount, also known as margin. Due to this, it's easy to gain exposure entirely to the underlying market. In addition, an investor’s profit and loss are only calculated according to the total size of their position, so leverage will show both profits and losses.

How do cryptocurrency markets operate?

Unveiling a few characteristics that drive cryptocurrency markets

Cryptocurrency markets have a tendency to be influenced by supply and demand parameters. Because they are decentralized, they are not impacted by the economic and political worries that plague traditional currencies. Their prices are heavily influenced by:

Supply

The total number of coins and the value at which they get unbound, lost, or devastated.

Market capitalisation

The total amount of coins in existence and how users anticipate it to be involved.

Press corps

The portrayal of cryptocurrency in the media and its media coverage.

Alliance

The simplicity with which cryptocurrency integrates into current infrastructure, such as e-commerce payment systems.

Macro events

Cryptocurrency markets are affected by various events like economic problems, changes in rules, and security breaches.